Subscribe to get the latest on artists, exhibitions and more.

Security and Speculation: Navigating the Price of Purity

An interview with conceptual artist shl0ms ahead of their performance, 'Security'.

What is your perspective on the relationship between art and money, and financial markets as drivers of culture?

Value and art are inextricable; as long as artists need money to produce art and to live they will keep making it, and as long as people value the work that artists produce they will keep buying it. Yet we seem to have some innate sense that there is a contradiction there, that art should have some sort of purity that transcends the lowly transaction. This idea permeates into culture and vacillates in a cycle between counterculture and aspirational annealing - from the hippies to the yuppies, then from the punks to the sell-outs, each era with their own perspective towards the extent to which an artist should reject institutions in service of purity or embrace them in service of ambition.

We now find ourselves in a bizarre transitionary period wherein the fine art market is coming off of a historic multi-decade bubble fueled by billionaires pursuing the veneer of respectability and tax writeoffs, chasing auction figures yet simultaneously turning their noses at what they perceive as the gauche hyperfinancialization of an alternate world in which art is given democratic and transparent liquidity and traded on a public ledger. I think the difference comes down to who is allowed to participate in the financialization of art - whether the access is gatekept to collectors who know the right gallerist and prices driven astronomically high for the work of a select few artists, or whether everyone can participate on both ends of the transaction. The traditional world has successfully pushed the narrative that the democratic alternative is somehow more zero-sum or extractive, when in reality it merely exposes what previously was sheltered behind gilded doors.

This same thread applies to all sorts of financial access, such as draconian securities laws limiting alternative high-return investments to accredited investors. Ultimately I believe the extreme speculative behavior we’ve seen in the crypto world is a symptom, not a disease - it stems from the sudden ability for the bourgeoisie to access markets they were previously barred from participating in. Yet the contradiction remains.

Security feels as if it condenses many ideas present across your practice: the examination of excess and exploration into the nature of art, engaging in a participatory dialog with an audience, the disruption and reconstruction of realities. How you see Security within your overall practice?

Many cryptoartists I admire have grappled with the question of cryptoart’s place in the financial system at various points in the satire-sincere spectrum, too many to name. One that sticks out to me is Brian L. Frye’s SEC No-Action Letter Request, a legal memo as artwork which argues that the sale of conceptual art violates the Securities Act of 1933, and proposes to prove itself by requesting an SEC no-action letter holding that the sale of the memo itself does not violate the securities laws.

I think one thing the conceptual corner of the cryptoart world does well is thoughtful critique enabled by or directed towards technology, but it is abysmal at garnering the requisite audience for the criticism and ultimately is largely preaching to a choir of people who already share the values and ideas espoused. Rather than simply minting an NFT critical of the SEC’s stance on the securities status of art, Brian pushed outside the conventional containers for cryptoart to make a more powerful statement. Instead of flaccidly yelling at the people who I would like to critique from the comfort of my Twitter account, I aim to not only bring the critique to them but have them participate in it.

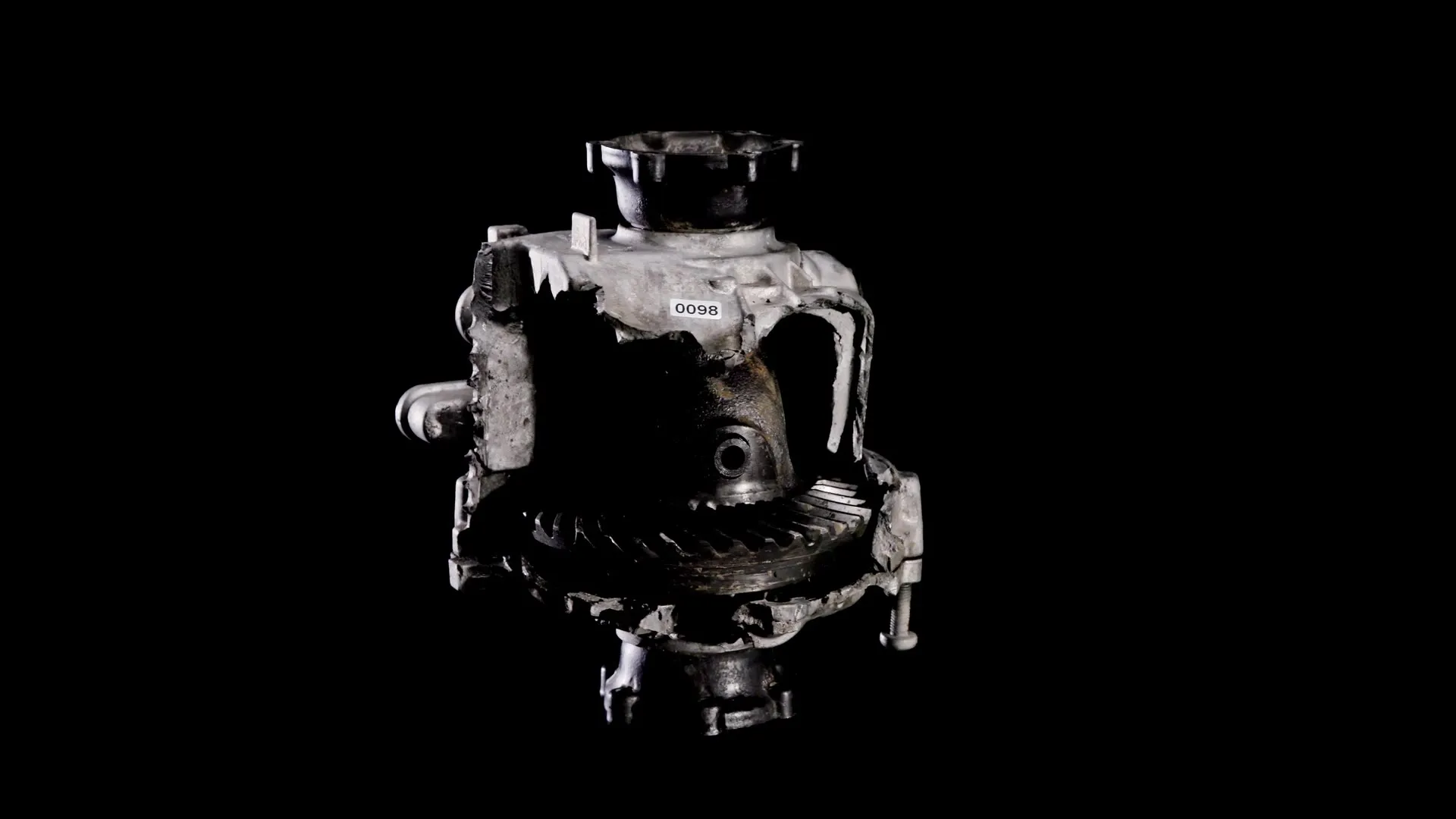

In a way, this is pulling on the same thread as SUNSET, a piece consisting of a hyper viral hoax about the imminent shutdown of Gmail and captured semi-permanently as an NFT hosted on Google’s servers. The actual art took place off-chain, on social media and in the ensuing panic and news frenzy, which was later captured and represented on-chain. The same logic can be applied to CAR, or a number of my works. I think it’s a much more expansive mindset toward what cryptoart can be than a simple bit of media or code with a blockchain pointer, and liberating in terms of the impact it can make.

Anything can be a canvas.

How is the pricing of the currency structured throughout the fair? Will early buyers acquire it at a lower price compared to later participants? Does the currency's value fluctuate during the fair to simulate real market speculation?

It is sold on quite an aggressive bonding curve, meaning the price increases and decreases along an exponential curve as participants buy and sell. We will be giving some of these art fair attendees a real taste of crypto degeneracy. It’s impossible to predict how people will actually interact with the work - whether people will be confused and ignore it, simply buy it for the experience, or lean into the trading aspect of it to buy and trade aggressively and trigger booms and busts. They are in total control of the demand and I place my trust in them to determine how the performance plays out, just like they will have to trust me as the de facto monetary authority. Perhaps I have some tricks up my sleeve…

How have you determined the total supply of the currency? Is there a fixed amount, or can it be expanded? Are there mechanisms in place to create scarcity or abundance to influence participant behaviour?

There is no supply cap, it is capped only by the convergence of its price towards infinity. This is part of the experiment and something that I think will be quite interesting to see people who have never used or heard of a DEX to grapple with. For all of the traditional art world’s emphasis on and obsession over supply I don’t think many of them have considered a work which has infinite theoretical supply and is governed purely by supply and demand. Or, for that matter, a work whose value can fluctuate so rapidly in the matter of minutes and can be sold sans intermediary directly back to the artist.

Could you go into the specifics of the currency itself, is it tokenized on a blockchain, and if so, which one? Is there an opportunity for people to engage with it online, or is it exclusively tied to the physical space? Do the physical certificates given to participants come with a digital counterpart?

More info on this after the conclusion of the public performance component.

SHL0MS

SHL0MS is an enigmatic conceptual digital artist whose work challenges conventional notions of artistic value. Operating under a pseudonym, they blur the lines between individual creation and collective expression. Their unorthodox and provocative projects explore themes of digital identity, financial disintermediation, viral misinformation, and the materiality of digital space.